Global growth is in slow mode, but a recession seems unlikely

Bad, worse, or as good as it gets

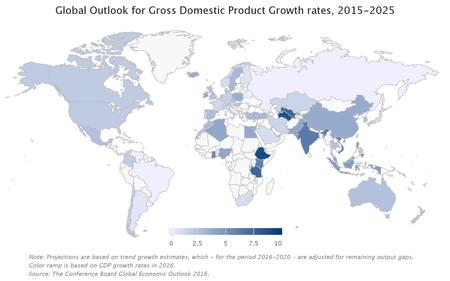

Uncertainty and pessimism have dominated the economic and business news in recent months. While at face value the mood seems justified as many negative factors (China’s financial gyrations, volatility in oil prices, and the further weakening of the US economy) are colluding, the recent developments by themselves do not yet signal an imminent global economic recession. Yet, the recent challenges to the global economy, have led to some significant adjustments in this first quarterly update The Conference Board’s Global Economic Outlook for 2016. Global GDP growth is now projected at 2.5 percent, which is 0.3 percentage point lower than our November outlook. The largest downward adjustments are seen in emerging markets, of which Brazil and Russia are the most pronounced, as their economic outlook has deteriorated more rapidly than we expected

To explore our full portfolio of related products, visit our member page.

Business Outlook

US: Will it continue to be a bright spot in a weak global economy?

- GDP growth for the United States is adjusted downward by 0.4 percentage points to 2.0 percent, as the GDP growth in the 4th quarter and jobs growth over the past months have been somewhat disappointing.

- Solid domestic demand will help overall GDP growth at 2.0 percent in 2016, which is slightly lower than 2015 growth rate.

- Raising profits will become increasingly difficult for companies as labor costs accelerate, labor productivity growth is modest, and interest rates are rising.

EURO-AREA: Recovery is likely to get better

- Despite increased political risks, the short-term economic environment in Europe has actually improved faster than we expected in our last update.

- As is the case in the US, domestic demand continues to drive the current moderate recovery.

- Investment and productivity are projected to improve in the coming decade, paving the way for somewhat of an acceleration in growth.

ASIA-PACIFIC: Growth is unlikely to improve

- Growth rates of China, India and Southeast Asia are unlikely to see significant improvement in 2016 compared to last year.

- Chinese growth in 2016 is expected to stay the same as that of 2015 at 3.7 percent (Alternative China GDP Series FAQ)

- After adjusting for China’s overstated official growth rates, India has already overtaken China as the growth champion of the region, but we do not expect an improvement in India’s growth performance in 2016 relative to 2015.

LATIN AMERICA: Losing the race?

- Rapid falls in oil and commodity prices negatively impacted Latin American economies, and exacerbated the ongoing troubles in the biggest economy in the region, Brazil.

- To help lift economic potential and drive productivity growth, more private sector and foreign investment is needed as well as integration of the informal sector into large and modern business practices.

AFRICA: Positive, but uncertain

- The prolonged decline in commodity prices, as well as weak growth in Nigeria and South Africa, will cause overall growth for the region in 2016 to come in at 3.7 percent – which is, though still an improvement from 2015, well below the average growth of the last few years.

- The region still has a lot of potential for economic expansion in the medium to long run, mainly due to its demographic dividend, and there is ample room for catch-up, but several political and institutional constraints offer significant uncertainty.

Related material (members only)

February 2016

- Strategic overview

November 2015

- A full overview of The Conference Board Global Economic Outlook 2016

- Business implications by major countries and regions

- Strategic overview

- Strategic implications for the Chief Financial Officer

- Strategic implications for the Chief Human Resource Officer

Next update

The next quarterly update of The Conference Board's Global Economic Outlook is scheduled for May 2016, and will be accompanied by a special report on the Sub-Saharan African economies and a StraightTalk publication.